The sub-brand market is getting more competitive

Once upon a time, Telstra stood alone in Australia’s sub-brand mobile market – where major telcos own and operate MVNOs. Telstra’s Belong dominated the space, battling with normal MVNOs that weren’t owned by any of the majors.

Fast forward to 2021, and all three of Australia’s major telcos now own a sub-brand mobile company as well. Optus announced the purchase Amaysim (the leading MVNO brand at the time) and launched Gomo – a small, digital sub-brand mobile company. TPG Telecom (Vodafone) launched Felix their own small sub-brand mobile company.

Both Optus and TPG Telecom launched their sub-brands in an attempt to compete with Telstra’s Belong, as well as other MVNOs. They all have similarities, but what’s different about sub-brands like Felix, Gomo, Belong, and Boost in general, and what are they doing to stand out from each other?

Sub-brand and MVNOs target a certain sector

Mobile Virtual Network Operators (MVNOs) are small phone companies that resell the major networks. This keeps their overhead low, and they focus on smaller and more targeted lineups than the major telcos do. As a result, MVNOs offer cheaper, straightforward plans with the basics.

Over the years, MVNOs have grown very popular. According to a Roy Morgan study, the MVNO market grew over 29 percent between 2014 and 2019, while major telcos declined by 71 percent during the same period.

This success has a lot to do with who MVNOs target. Their plans tend to be bought by younger, more savvy Australians on a budget, who know more about phone plans that their older counterparts. Their lower servicing costs and sometimes online/app-only approach also targets the younger demographic.

Larger telcos sat on the sidelines for a while, watching this growth. Telstra, however, took an early dip into the MVNO market with Belong and Boost. The success has been undeniable so far. In fact, in the first half of last year, Belong accounted for over 60 percent of Testra’s new postpaid customers, and all of Telstra’s new broadband customers.

With the potential of the market becoming obvious, both Optus and Vodafone have now entered the market with sub-brands of their own.

Belong, Boost, Gomo, and Felix

Now that all three major telcos have launched sub-brands, it’s difficult to separate them from typical MVNOs. In fact, the major difference is that those sub-brands are owned by major telcos, rather than just reselling their networks.

But what’s clear is that there seems to be a new market emerging, separate from the MVNO market. Perhaps a sub-brand market where the major telcos compete, but with their smaller phone companies.

With Belong and Boost, Telstra was a first mover in the sub-brand market. Now, all of a sudden, the market is crowded with Optus’ purchase of Amaysim and launch of Gomo, as well as TPG Telecom’s launch of Felix.

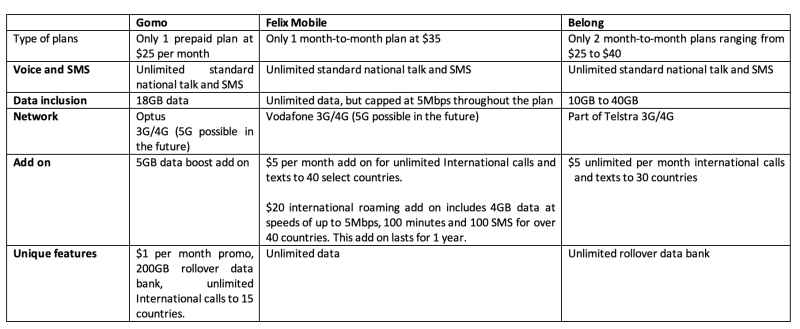

Here’s a quick side-by-side comparison of Belong, Gomo, and Felix:

How is Belong handling the newfound competition?

Belong chief executive Jana Kotatko is aware of how competitive the sub-brand market has become with Optus and TPG Telecom both launching their own sub-brands.

Kotako, however, is not interested in cutting prices to compete with Gomo and Felix. Instead, Belong will focus on the following options to stay competitive:

- Increase data inclusions on current plans, but keep price the same

- Expand target area to regional parts of the country

Belong’s plan shows that the competition in the sub-brand market is really around data inclusions, and not price points. But this isn’t not really absolute, considering both Gomo and Felix beat Belong on data inclusions at similar or lower price points. For instance, Belong’s $25 plan includes 10GB of data, compared to 18GB on Gomo’s $25 plan. Felix is also data-focused, with unlimited data capped at 5mbps for just $35.

But Kotako is not concerned about price points, stating that the real differentiator in the sub-brand market will come down to “network offering and service offering.”

Because Belong uses the Telstra network, they benefit from the reputation of having the widest coverage in Australia. And Telstra’s lead in rural areas is significant, which explains why Belong’s ambition to target rural areas can result in a good competitive edge.

Final words

The sub-brand market is becoming crowded, giving Telstra’s Belong some work to do. And considering how promising the market is, Belong will have to remain dominant.

For the sub-brand market in general, telcos will have to find ways to stand out. While Belong suggests rural expansion and increased data inclusions, perhaps other features like 5G, multi SIMs, and eSIMs might drive growth, especially in second/third devices like tablets and wearables.

But for now, none of these are available to any of the sub-brands. In the coming months, it will be interesting to see if that will change, and how other sub-brands will react to such change.